In Japan, companies conduct year-end tax adjustments of their employees every year between November and December. At that time, employees are required to submit documents that are necessary to calculate the difference between their withholding income tax and the exact amount of income tax. If you are a foreign national working in Japan, you may have experienced some difficulties at year-end tax adjustment. In this article, we will explain about year-end tax adjustment and withholding tax statements in Japan.

1.What is nenmatsu chosei?

年末調整/ねんまつちょうせい (year-end tax adjustment) is an adjustment of the excess or deficiency of the income tax by comparing the income tax to be paid by the employee for the year and the income tax deducted from the employee’s monthly salary and bonus. Although the tax amounts are deducted from the monthly salary as withholding tax, they are just estimates. There may also be an over or underpayment when there is a change in salary or family structure, or career change during the year. Therefore, once the salary of the year is determined, the company recalculates the tax according to the employee’s salary between January and December, and adjusts the excess or deficiency and determines the amount of tax to be paid, on behalf of the employee.

1-1.Who is/is not subject to nenmatsu chosei?

Foreigners who have an address in Japan or have been living in Japan for more than a year are subject to year-end tax adjustment, since their tax is handled basically the same as Japanese workers. In addition, foreign technical interns/trainees and interns are also eligible if they meet these conditions. On the other hand, those who have their address overseas or work in Japan on a working holiday are not subject to year-end tax adjustment.

1-2.How to submit nenmatsu chosei

The documents and their areas to fill out differ depending on the salary earner’s situation, such as “have/do not have spouse”, “have/do not have various insurance premiums such as life insurance and earthquake insurance” and “with/without housing loan”. Therefore, you need to declare the amount of deduction correctly for each item that applies to you. If you have some difficulty in understanding, you can refer to the declaration form in your native language and confirm it carefully, and fill out the form in accordance with the instructions by the HR person in your company.

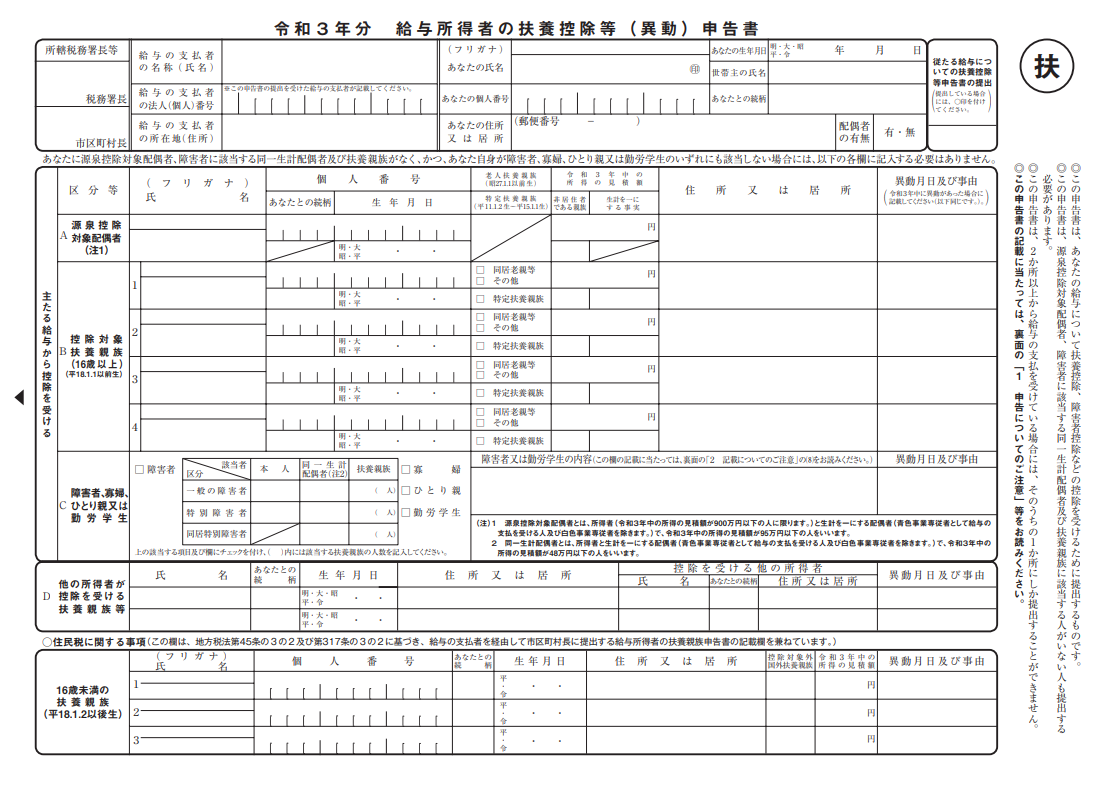

Example of nenmatsu chosei

Example of nenmatsu choseiBelow are the specific items required for nenmatsu chosei.

・Individual number of Individual Number Card

・Personal seal (signature is also acceptable)

・Application for (change in) Exemption for Dependents of Employment Income Earner

・Application for Basic Exemption of Employment Income Earner and Application for Exemption for Spouse of Employment Income Earner and Application for Exemption of Amount of Income Adjustment

・Application for Special Exemption for Housing Loan, etc. for Employment Income Earner, Certificate of Balance of Housing Loan, Certificate of Special Exemption for Housing Loan, etc. (note: in case there is special exemption for housing loan, etc.)

・Application for Deduction for Insurance Premiums for Employment Income Earner, certificate of insurance premium deduction issued by insurance companies (note: if the applicant is insured)

・Documents Concerning Relatives, Documents Concerning Remittances, etc. (note: in the case that the applicant receives a dependent exemption and have dependents outside Japan)

* Items in bold apply to all of the applicants.

Declaration forms in foreign languages (English, Chinese, Portuguese, Spanish and Vietnamese) are available on the National Tax Agency website, so you can check the details of the form.

2.What is gensen choshuhyo?

源泉徴収票/げんせんちょうしゅうひょう (withholding tax statement) is a document distributed by your company when the end of the year is approaching. It shows how much you were paid and how much income tax you paid during the year at a glance. When you resign in the middle of the year, you will be handed a withholding tax statement including the total amount of your salary and the total amount of income tax deducted from your salary between January 1st of the year and the day of your resignation.

2-1.How to read gensen choshuhyo

In order to confirm your income and earnings on your withholding tax statement, make sure the following four items are correct.

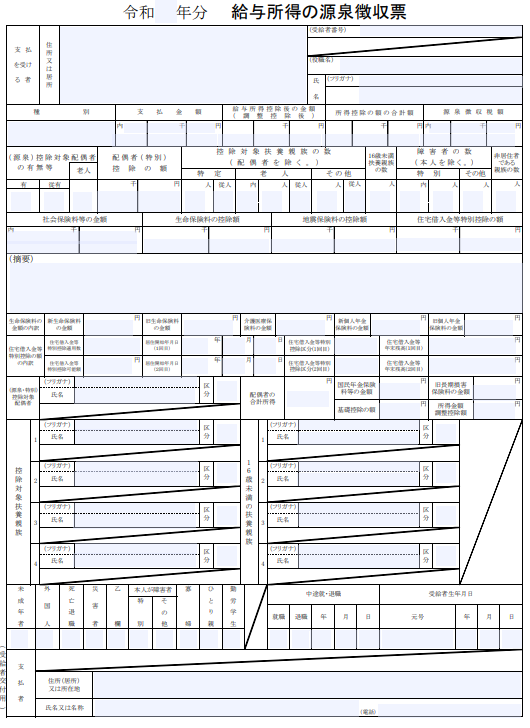

Example of gensen choshuhyo

Example of gensen choshuhyo

支払金額/しはらいきんがく(Payment amount): Total amount of the money paid by the company such as base salary, various allowances such as overtime salary and bonus, and incentives, is listed.

給与所得控除後の金額/きゅうよしょとくこうじょごのきんがく(Amount after the employment income deduction): This is the amount that employment income deduction are deducted from the paid amount. The amount of employment income deduction is determined by the National Tax Agency.

所得控除の額の合計額/しょとくこうじょのがくのごうけいがく(Total amount of income deduction): The total amount of various insurance premium deductions, basic exemption, exemption for dependents, deduction for earthquake insurance premiums, etc. are listed.

源泉徴収税額/げんせんちょうしゅうぜいがく(Withholding tax amount): The amount of income tax paid for the year is listed.

2-2.Keeping gensen choshuhyo

Withholding tax statement is also required when you change jobs. If you are considering or have already decided a career change, you should be sure to keep your withholding tax statement. In addition, you need a withholding tax statement if you change jobs from one year to the next, if you have an annual income greater than 20 million yen, or if your secondary income exceeds 200,000 yen, as you need to file an income tax report. Furthermore, if you want to apply for the special deduction for housing etc. related to a dwelling, you may want to keep your withholding tax statements for three to five years, as you may be required to submit them for the past three years.

3.Summary

Year-end tax adjustment is a procedure that many employees should do. Although there are many documents to be submitted and it can be time consuming, this article will help you understand the important issues and make the procedure smooth.

Learning Japanese

Business Japanese

List of ways to look for jobs in Japan

- Recruitment Agency for Expats in Japan

- Job Board for Expats in Japan

- Search for jobs by occupation in Japan

- Search for jobs by industry in Japan

Job Hunting Guide for International Students

jopus編集部

Latest posts by jopus編集部 (see all)

- 【Osaka】Corporate sales of trading companies - 11/18/2021

- 【Jopus Connecter】Web Engineer Job List - 11/1/2021

- 【October 26】Jopus Connecter version 0.3.5 Release Notes - 10/26/2021